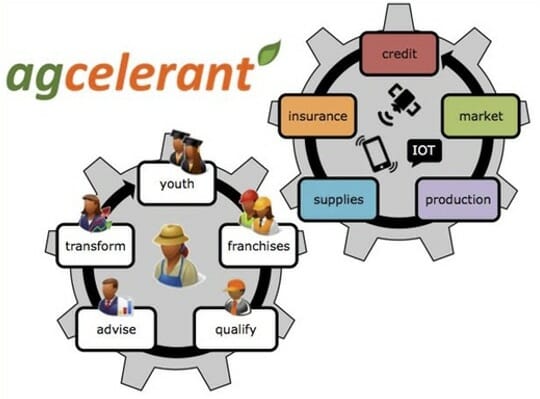

With the premise that access to credit is only possible once investment risk is quantified (reducing finance institutions cash-out), more robust and socially-differentiated agricultural insurance is accessible and affordable (reducing exposure to persistent climate risk), and granular advisories support the tactical management of crop nutrient deficiencies and post-harvest losses (increasing productivity, harvest quality and income), agCelerant™ implements an innovative, holistic business model in which the entire value chain is simultaneously accompanied and protected as they empower themselves to respond to growing and changing customer needs.